Master Professional Debt Mediation: Step-by-Step Guide

Overview

This article offers a caring, step-by-step guide to mastering professional debt mediation, focusing on a structured process designed to help both debtors and creditors find mutually acceptable resolutions. Have you ever felt overwhelmed by debt? You're not alone. Mediation can be a powerful tool in navigating these challenges.

Key steps in mediation include:

- Preparation

- Negotiation

- Follow-up

Each step is crucial in fostering understanding and collaboration. However, it's important to recognize that challenges may arise along the way. Selecting a qualified mediator can significantly enhance the chances of achieving a successful outcome, ensuring you feel supported throughout the process.

Imagine a scenario where both parties leave the table feeling heard and respected—this is the essence of effective mediation. By embracing this approach, you can transform the way you handle debt, paving the way for a brighter financial future. Together, let's explore how you can take the first step towards resolution.

Introduction

Navigating the complexities of debt can feel overwhelming, leaving many of us feeling trapped and uncertain about our financial future. Professional debt mediation offers a structured and compassionate approach to resolving these challenges. It enables debtors and creditors to engage in meaningful dialogue, paving the way for favorable outcomes.

Yet, the mediation process is not without its obstacles. What strategies can we employ to ensure a successful resolution? This guide delves into the essential steps of professional debt mediation, equipping you with the knowledge and tools necessary to reclaim control over your financial life.

Understand Professional Debt Mediation

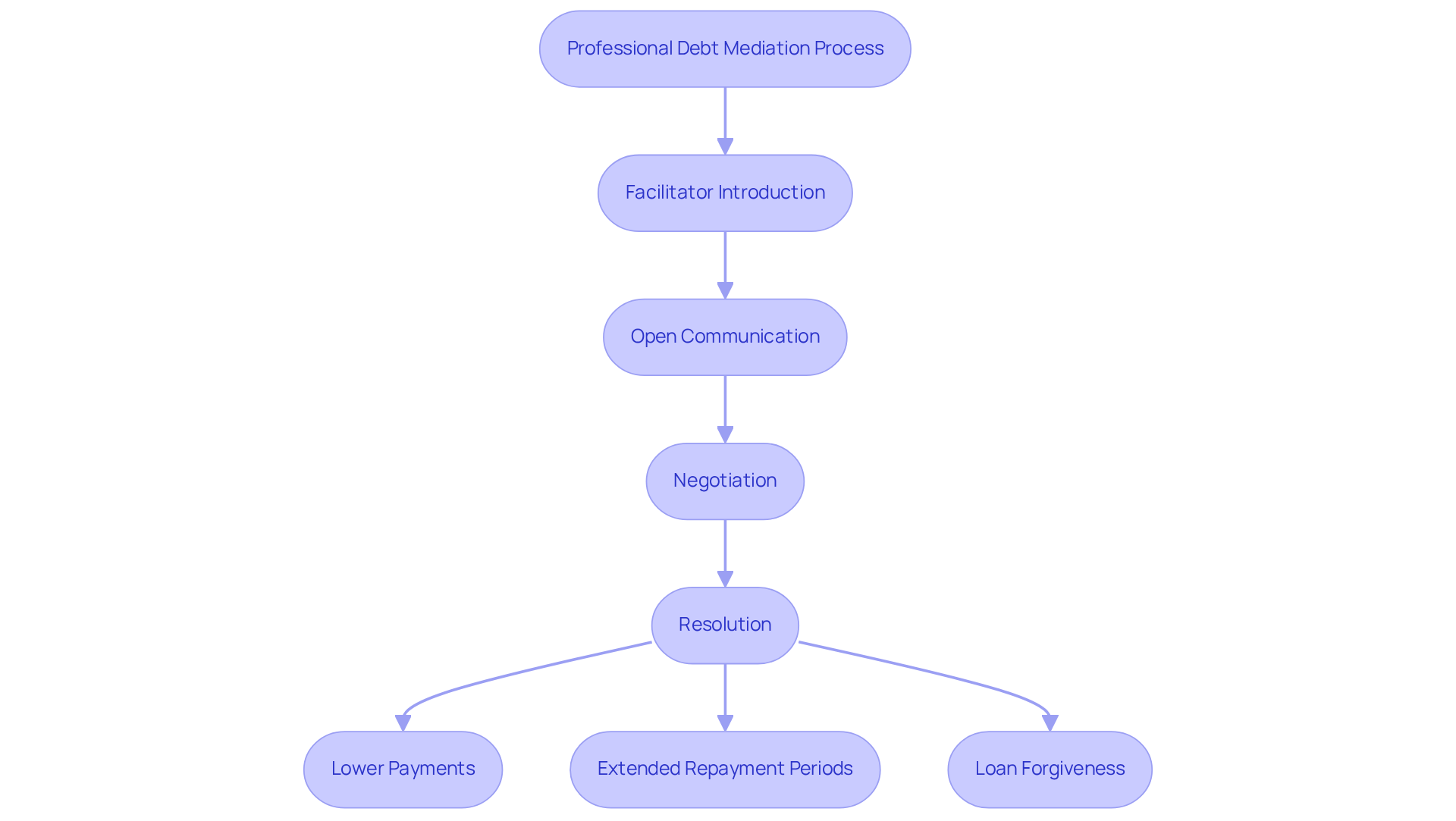

Professional debt negotiation is a structured process where a neutral individual, known as a facilitator, compassionately assists debtors and creditors in achieving a mutually acceptable resolution to outstanding debts. This process is designed to promote open communication, allowing both sides to express their concerns and negotiate terms that feel agreeable to everyone involved. The mediator does not make decisions for the parties but gently guides them toward finding a solution that works for both sides.

Understanding this procedure is crucial for anyone considering negotiation as a way to address their financial challenges. It can lead to lowered payments, extended repayment periods, or even loan forgiveness in certain situations. Furthermore, conflict resolution is often less adversarial than litigation, making it a more amicable option for settling financial disputes.

Key Benefits of Professional Debt Negotiation:

- Lower Payments: Negotiating can help reduce the total amount owed.

- Extended Repayment Periods: You may have more time to pay off your debts.

- Loan Forgiveness: In some cases, part of your debt may be forgiven.

If you find yourself overwhelmed by financial concerns, remember that you are not alone. Seeking support through professional debt mediation can be a significant step toward regaining control of your financial future.

Follow the Mediation Process Step-by-Step

-

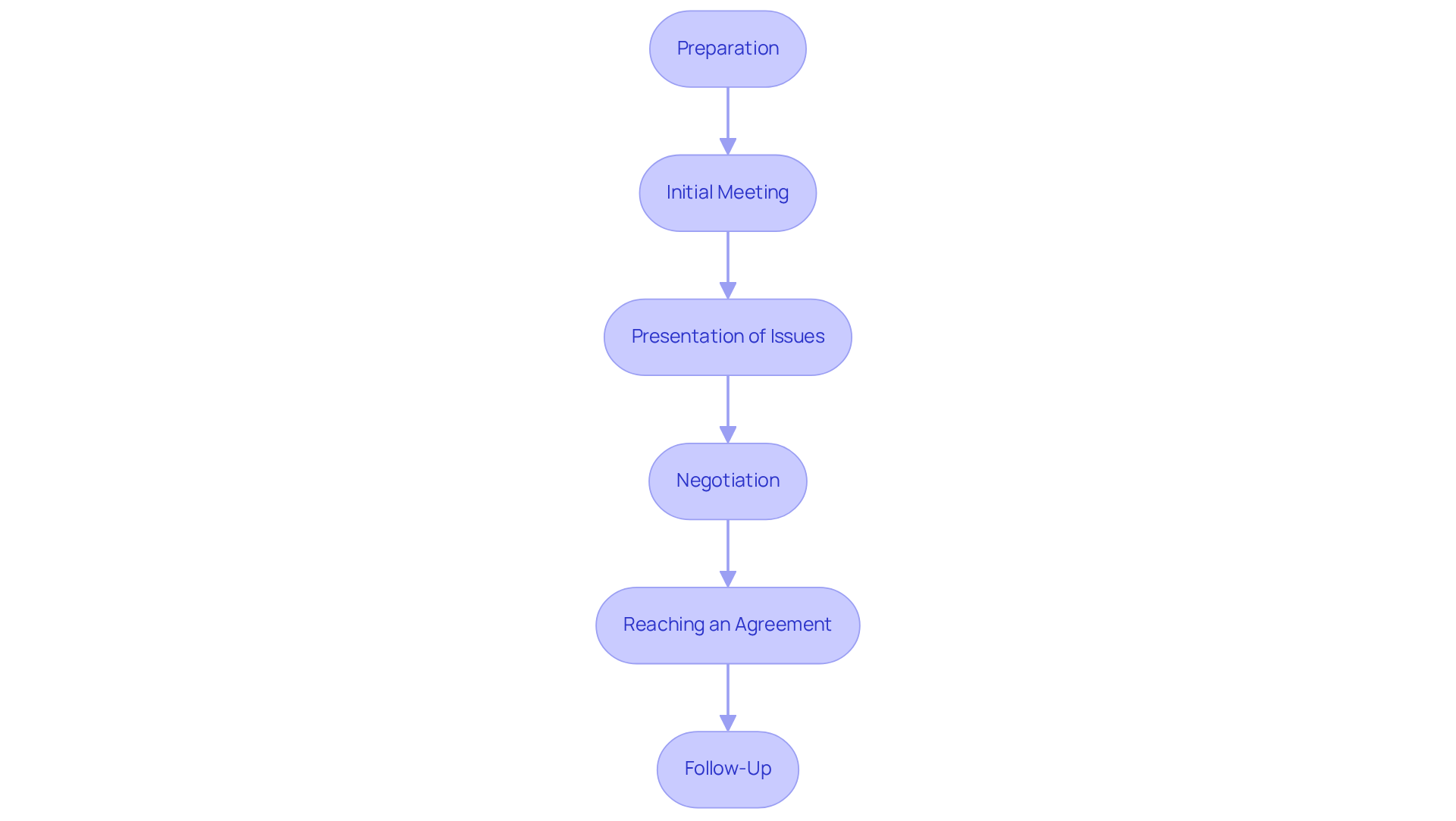

Preparation: Before embarking on your negotiation journey, take a moment to gather all relevant documents. This includes your financial statements, payment history, and any communication with your creditors. Understanding your financial situation is not just important; it’s essential for your peace of mind.

-

Initial Meeting: The professional debt mediation session typically begins with a warm introduction by the facilitator. They will explain the process and set ground rules for communication, creating a safe space for everyone involved.

-

Presentation of Issues: Each group has the chance to share their perspective on the debt situation. This moment is vital; it’s an opportunity to express your concerns and outline the outcomes you desire. How do you feel about your current situation?

-

Negotiation: The facilitator plays a crucial role in guiding conversations among the groups. They encourage everyone to explore different solutions for resolution, including professional debt mediation as a potential path forward. Together, you can find a way to navigate these challenges.

-

Reaching an Agreement: If both parties find common ground, the mediator will assist in drafting a settlement agreement. This document will clearly outline the terms of your resolution, ensuring that everyone is on the same page.

-

Follow-Up: After your discussion, it’s essential to follow through on all agreed-upon actions. This may involve making payments or adjusting account terms as specified in the agreement. Remember, taking these steps is key to moving forward and achieving the resolution you seek.

Overcome Challenges in Mediation

-

Emotional Barriers: It’s completely normal to feel anxiety or frustration during this process. Remember, staying calm and focused is essential. By practicing relaxation techniques beforehand, you can ease those feelings and approach the situation with a clearer mind.

-

Communication Issues: Misunderstandings can happen, and they can be frustrating. How can we prevent this? By actively listening to the other party and clarifying any points of confusion promptly, we can foster a more productive dialogue.

-

Unrealistic Expectations: Entering negotiations with rigid demands can hinder our progress. Instead, let’s embrace the idea of compromise and remain flexible in our approach. This openness can pave the way for finding mutually beneficial solutions.

-

Power Imbalances: If one party feels intimidated, it’s important to address that. A facilitator can help equalize the situation, ensuring both sides have the same opportunities to express themselves and feel heard.

-

Lack of Preparation: Arriving unprepared can lead to unproductive facilitation. To set ourselves up for success, let’s ensure we have all necessary documents and a clear understanding of our financial situation. This preparation can significantly enhance the quality of our discussions.

Choose the Right Mediator for Your Needs

-

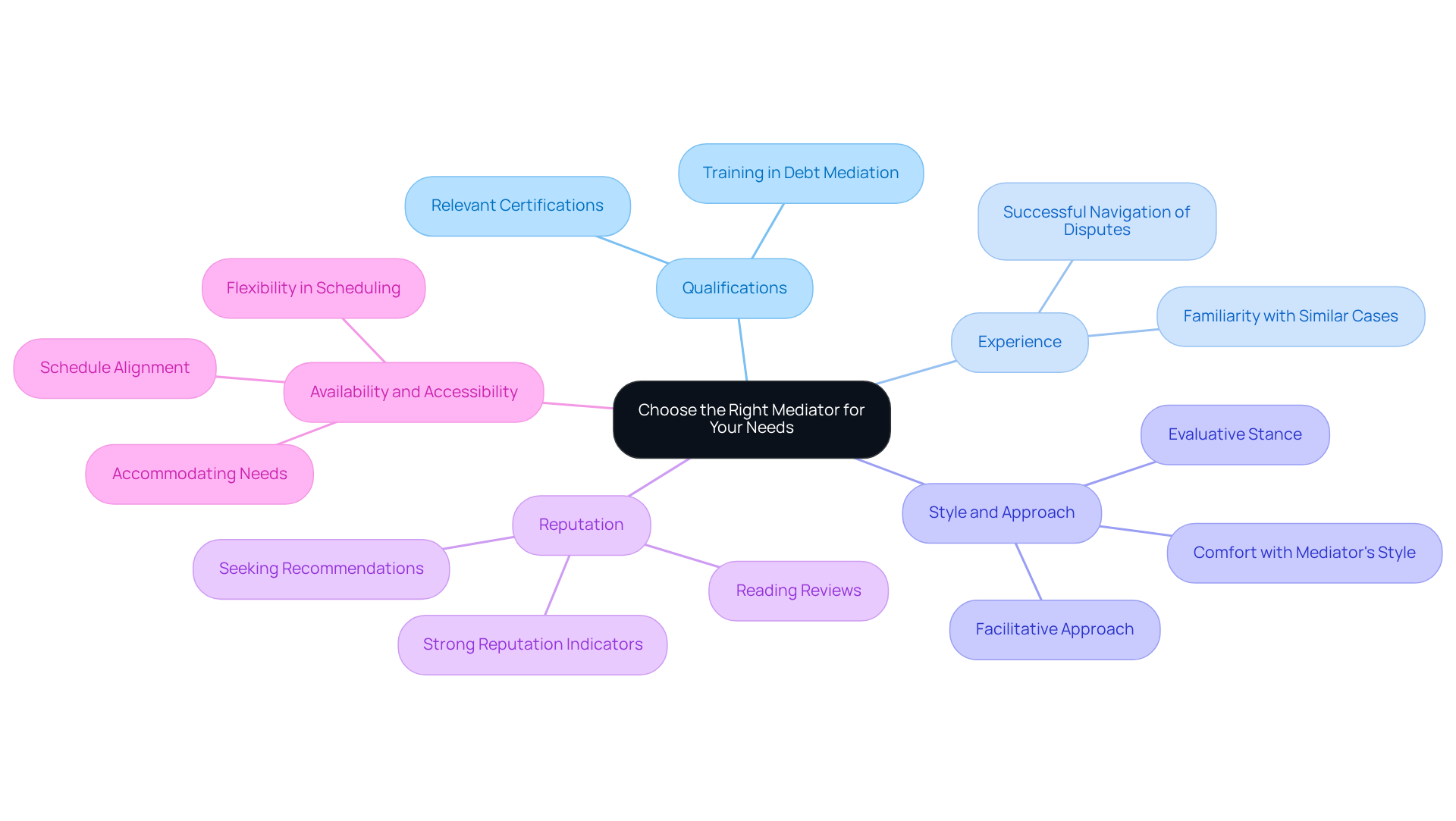

Qualifications: It's important to seek individuals who possess relevant certifications and training in professional debt mediation. Their expertise in professional debt mediation can truly make a difference, providing you with the guidance you need during the mediation process.

-

Experience: Look for facilitators who have successfully navigated debt-related disputes using professional debt mediation in the past. Their familiarity with similar cases can significantly enhance their ability to help you find a resolution through professional debt mediation that works.

-

Style and Approach: Remember that different facilitators have their own unique styles. Some may lean towards a more facilitative approach, while others might adopt an evaluative stance. Choose one whose style feels comfortable for you, as this can greatly influence your experience.

-

Reputation: Take the time to investigate potential intermediaries by reading reviews or seeking recommendations from trusted sources. An intermediary with a strong reputation is likely to provide a more positive and supportive experience.

-

Availability and Accessibility: Ensure that the mediator's schedule aligns with yours. Flexibility in scheduling can be crucial, especially if you're facing time constraints. Finding someone who can accommodate your needs can alleviate some of the stress during this process.

Conclusion

Mastering professional debt mediation can be a powerful ally in your journey toward financial relief. This structured process not only encourages open communication between debtors and creditors but also creates a nurturing environment where mutually beneficial resolutions can flourish. By understanding the steps involved and the benefits of negotiation, you can take control of your financial situation and work towards a more secure future.

In this article, we’ve highlighted key aspects of the mediation process, such as:

- Preparation

- Effective communication

- The invaluable role of a skilled mediator

Each step, from the initial meeting to reaching an agreement, is crafted to foster a supportive atmosphere that encourages dialogue and compromise. We’ve also addressed common challenges like emotional barriers and unrealistic expectations, providing practical strategies to overcome them. This ensures that you are well-equipped for your mediation journey.

Ultimately, engaging in professional debt mediation can be a transformative experience, offering a pathway to financial stability. It’s crucial to choose the right mediator—someone with the necessary qualifications and experience to guide you effectively. By taking proactive steps and embracing the opportunities that mediation provides, you can pave the way for a brighter financial future. Remember, seeking help and support is a vital part of navigating the complexities of debt. You are not alone on this journey.

Frequently Asked Questions

What is professional debt mediation?

Professional debt mediation is a structured process where a neutral facilitator assists debtors and creditors in reaching a mutually acceptable resolution to outstanding debts, promoting open communication and negotiation.

What role does the mediator play in the debt negotiation process?

The mediator guides the parties toward finding a solution that works for both sides but does not make decisions for them.

What are the key benefits of professional debt negotiation?

The key benefits include lower payments, extended repayment periods, and potential loan forgiveness.

How can professional debt mediation help with financial challenges?

It can lead to reduced total amounts owed, more time to pay off debts, and in some cases, forgiveness of part of the debt, making it a less adversarial option than litigation.

What should individuals consider if they are overwhelmed by financial concerns?

Individuals should consider seeking support through professional debt mediation as a significant step toward regaining control of their financial future.