Master NASD Arbitration Rules: Essential Steps for Success

Overview

Mastering NASD arbitration rules can feel daunting, but taking essential steps can lead to success. Understanding the arbitration process is crucial, as is preparing the necessary documentation. By following the structured procedures for filing and presenting a claim, you can navigate this journey with confidence.

Being well-informed about these steps is vital. For instance, submitting a Statement of Claim and ensuring compliance with procedural requirements are key actions that can lead to a fair and efficient resolution of disputes. Imagine the relief of knowing you’re on the right path, enhancing the likelihood of a favorable outcome.

Remember, you’re not alone in this process. We’re here to support you every step of the way. Embracing these guidelines can empower you to approach arbitration with clarity and assurance. Together, we can work towards achieving the resolution you deserve.

Introduction

Navigating the complexities of financial disputes can feel overwhelming, especially when the stakes are high and emotions are heightened. We understand that this journey can be fraught with uncertainty. The NASD arbitration rules provide a structured and compassionate pathway to resolve conflicts between investors and brokerage firms, offering a more efficient alternative to traditional litigation. Yet, as the process unfolds, it’s natural to have questions about filing claims, understanding awards, and ensuring compliance.

How can you effectively master these rules to secure a favorable outcome while minimizing stress? By embracing the NASD arbitration process, you are taking a proactive step towards resolution. Remember, you are not alone in this; we are here to support you every step of the way.

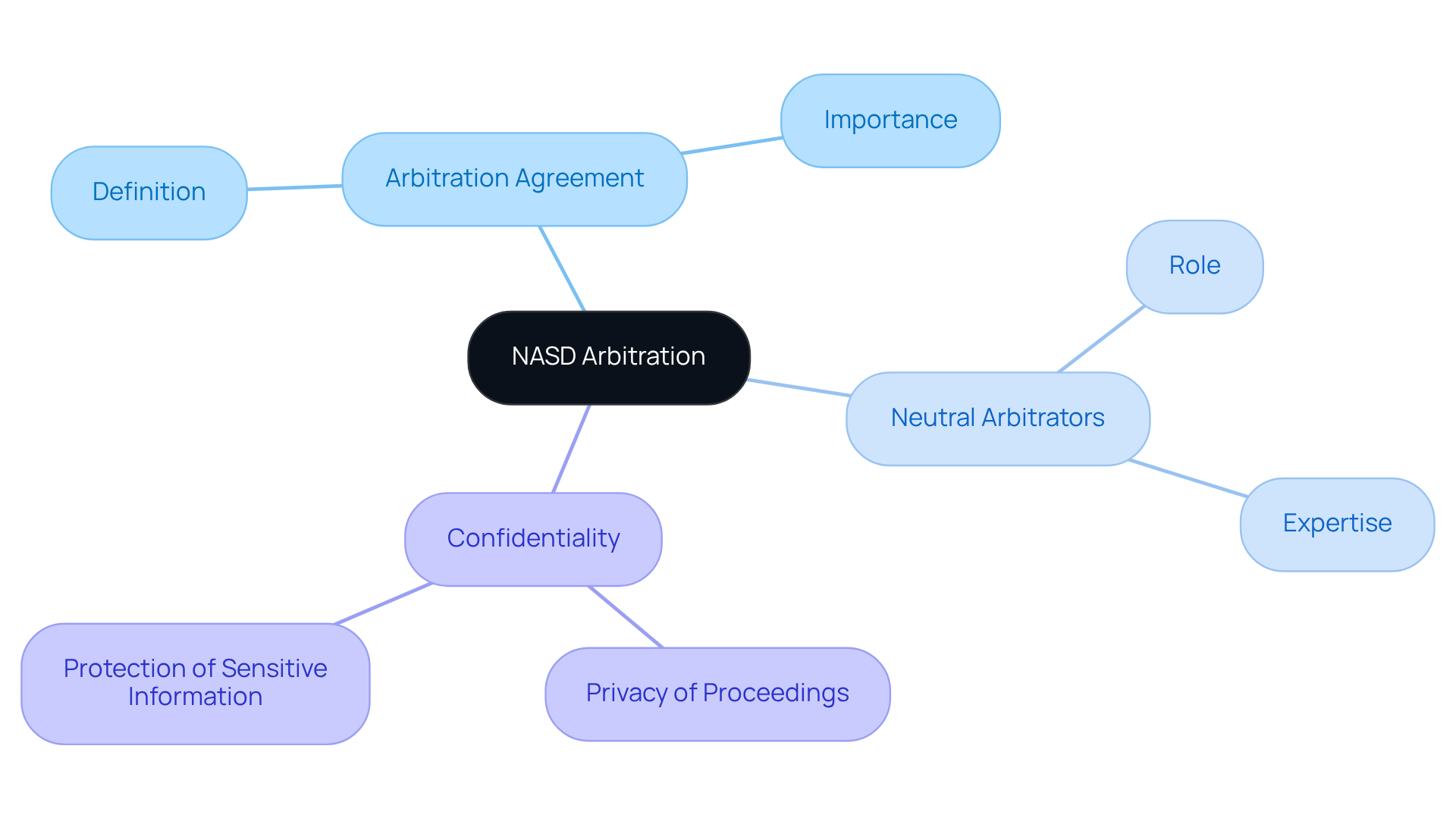

Define NASD Arbitration: Key Concepts and Importance

Navigating conflicts between investors and brokerage firms can feel overwhelming, but there's a compassionate way to resolve these disputes without the stress of litigation. This process, which adheres to the NASD arbitration rules, is designed to provide a fair, efficient, and cost-effective means of resolution. Let's explore some key concepts that can help you feel more at ease:

- Arbitration Agreement: This is a contract that often mandates arbitration for disputes, typically signed when you open an account. It sets the stage for a smoother resolution.

- Neutral Arbitrators: These trained professionals listen to your case and make binding decisions based on the evidence you present. Their expertise ensures a fair process.

- Confidentiality: The proceedings are generally private, protecting your sensitive information from public disclosure, allowing you to speak freely.

Understanding financial dispute resolution is significant because it can accelerate the resolution process under the NASD arbitration rules, often leading to results faster than traditional court procedures, which can be time-consuming and costly. In fact, according to SIFMA, nearly 75% of customer cases are resolved favorably for the industry through this compassionate process. This statistic underscores the efficiency of arbitration compared to litigation.

Consider the NYSE lawsuit against California; it illustrates the complexities involved in dispute resolution and the ongoing discussions surrounding regulations. Legal specialists emphasize the importance of grasping these essential concepts to navigate the dispute resolution environment effectively. While this form of resolution offers numerous advantages, it’s also crucial to reflect on potential criticisms and challenges that may arise within this framework.

By understanding these processes and embracing the support available, you can confidently navigate your path toward resolution.

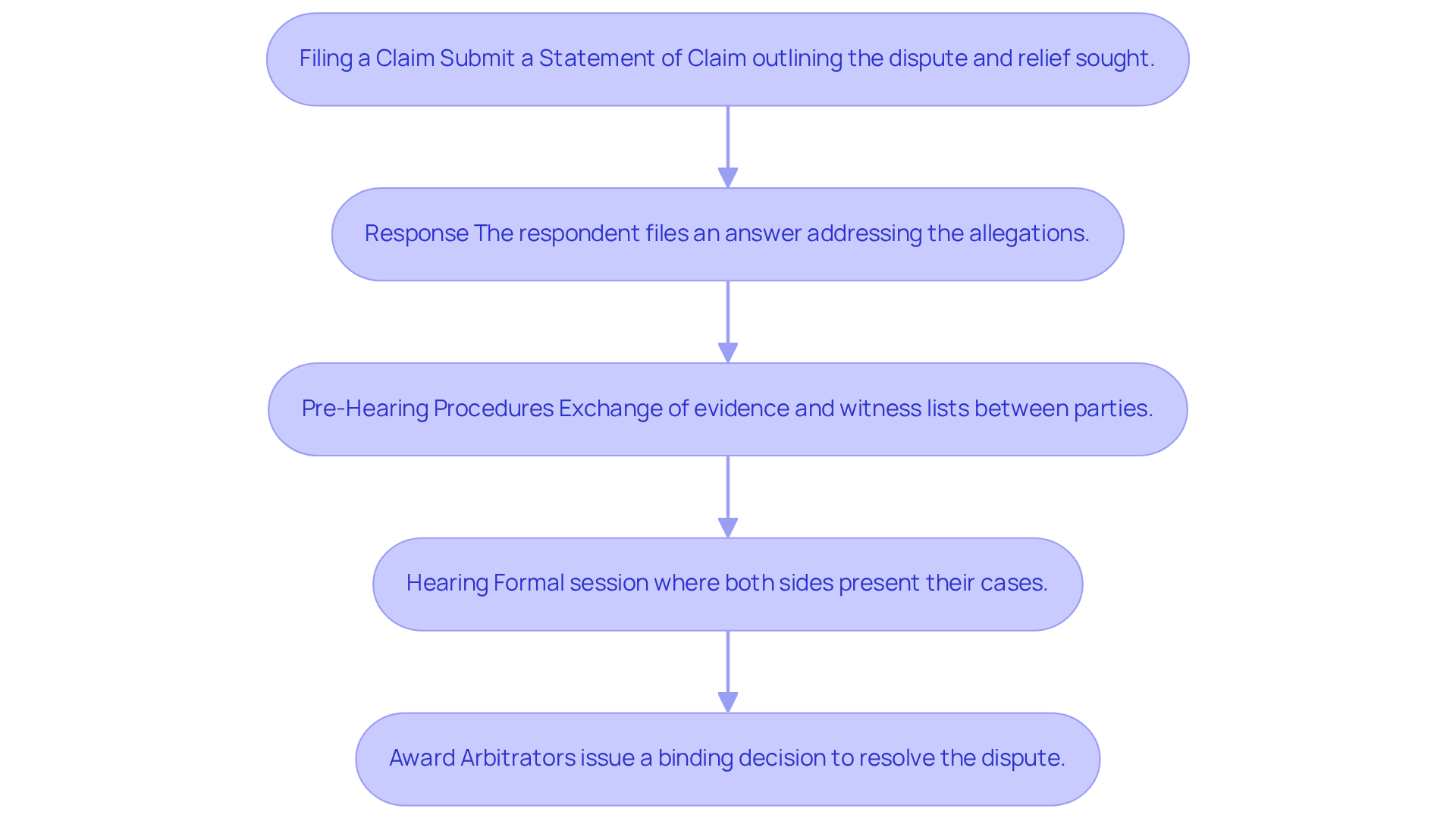

Outline NASD Arbitration Rules: Structure and Procedures

Navigating the NASD arbitration rules can feel overwhelming, but understanding this organized collection of guidelines can help you resolve conflicts effectively. Here’s a gentle overview of the key components of this process:

- Filing a Claim: It all starts with you submitting a Statement of Claim. This document outlines the nature of your dispute and the relief you are seeking.

- Response: The other party, known as the respondent, must file an answer to your claim, addressing the allegations you presented.

- Pre-Hearing Procedures: During this phase, both parties exchange evidence and witness lists. This ensures that everyone is adequately prepared for the hearing ahead.

- Hearing: This is a formal session where both sides present their cases, including witness testimonies and supporting evidence. It’s an opportunity for your voice to be heard.

- Award: After the hearing, the arbitrators will issue a binding decision known as an award, which resolves the dispute.

Understanding these steps is essential for navigating the dispute resolution process with confidence under the NASD arbitration rules. By being informed, you can ensure compliance with procedural requirements, ultimately leading to a fair outcome. Remember, you are not alone in this journey; we are here to support you every step of the way.

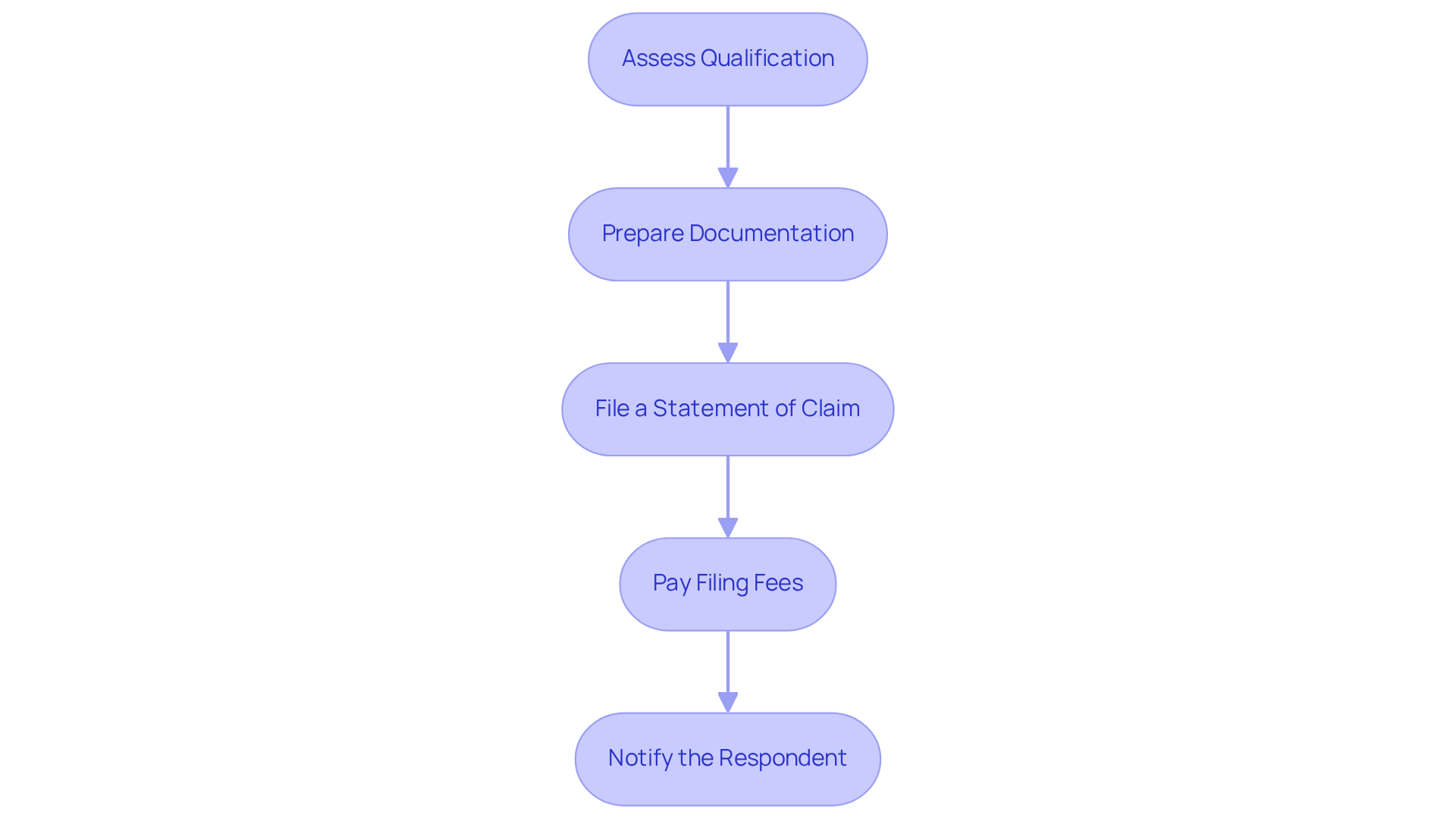

Guide to Initiating NASD Arbitration: Steps and Best Practices

Initiating NASD arbitration can feel overwhelming, but understanding the NASD arbitration rules can help ease your concerns. Here’s a gentle guide to navigate this process:

- Assess Qualification: First, let’s ensure your issue is within the NASD’s authority, typically relating to client grievances against member companies. This step is crucial for your peace of mind under the nasd arbitration rules.

- Prepare Documentation: Gather all relevant papers, like account statements, correspondence, and agreements related to your issue. Having everything in one place can make a significant difference.

- File a Statement of Claim: Next, submit your claim to the relevant authority. Include a detailed description of your issue and the relief you seek. This is your chance to share your story.

- Pay Filing Fees: Be ready to pay the necessary fees, which can vary depending on the amount in dispute. Understanding this upfront can help you plan accordingly.

- Notify the Respondent: Once your claim is filed, NASD will inform the other party, who must respond. This ensures that everyone is aware of the situation.

Best Practices:

- Consult Legal Counsel: Engaging an attorney experienced in arbitration can provide invaluable support and guidance.

- Be Thorough: Make sure all your documentation is complete and accurate. This diligence can prevent delays and keep the process moving smoothly.

- Stay Organized: Keep track of all communications and deadlines. Staying organized can help alleviate stress during this time.

Remember, you are not alone in this journey. If you have questions or need further assistance, please reach out for support. Taking these steps can lead you toward resolution and peace of mind.

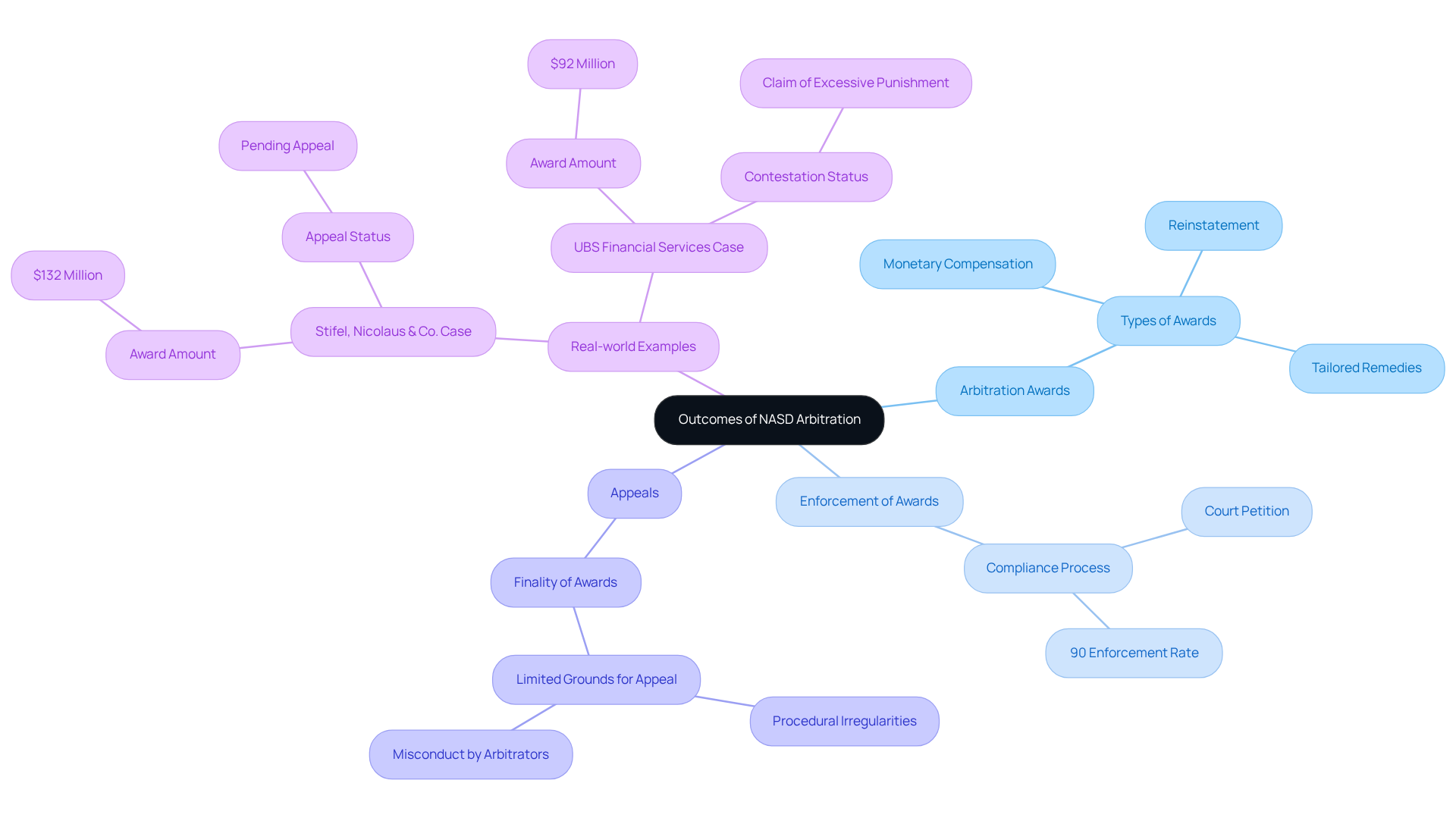

Explore Outcomes of NASD Arbitration: Awards and Enforcement

The outcomes of the NASD arbitration rules in dispute resolution can have significant consequences for everyone involved, and it’s important to understand what that means for you. Here are some key elements to consider:

-

Arbitration Awards: These binding decisions made by arbitrators can provide various forms of relief, including monetary compensation, reinstatement, or other remedies tailored to your specific situation.

-

Enforcement of Awards: If a party does not comply with the award, the prevailing party has the right to seek enforcement through the courts. This process typically involves submitting a petition to a court with appropriate jurisdiction. It’s reassuring to know that around 90% of dispute resolution awards are upheld in court, highlighting the effectiveness of this system in ensuring compliance.

-

Appeals: Generally, arbitration awards are final and binding, with limited grounds for appeal. These grounds mainly focus on procedural irregularities or misconduct by the arbitrators. It’s essential for you to fully grasp the implications of the dispute resolution method, particularly the NASD arbitration rules, that you choose.

Real-world examples can shed light on the enforcement landscape. In a recent case, Stifel, Nicolaus & Co. was ordered to pay approximately $132 million to investors due to misrepresentations about the risks of complex financial products. This situation underscores the potential for significant awards to be upheld, emphasizing the importance of adhering to dispute resolution outcomes and the serious repercussions of non-compliance.

Legal professionals stress that understanding the enforcement process is crucial for anyone navigating the post-arbitration landscape under the NASD arbitration rules. As Scott Silver wisely states, "For investors who have been deceived by a financial advisor or others, FINRA mediation is often the most effective venue to obtain compensation for losses." By being aware of your rights and the methods available for enforcing awards, you can better protect your interests and ensure compliance with decisions. Additionally, under FINRA Rule 9554, arbitration awards must be paid within 30 days of being granted, further highlighting the urgency of compliance.

In this journey, remember that you are not alone. We are here to support you every step of the way.

Conclusion

Mastering NASD arbitration is essential for effectively navigating disputes between investors and brokerage firms. This process offers a compassionate and efficient alternative to litigation, allowing for a fair resolution while safeguarding sensitive information. By understanding key concepts of NASD arbitration—such as arbitration agreements, neutral arbitrators, and confidentiality—you can approach your conflicts with confidence and clarity.

Throughout this article, we’ve outlined critical steps in the NASD arbitration process, including filing a claim, preparing documentation, and understanding potential outcomes of arbitration awards. These structured guidelines ensure you are well-equipped to engage in the process. Moreover, by emphasizing best practices, such as consulting legal counsel and staying organized, we enhance the likelihood of a favorable resolution. Notably, the high compliance rate with arbitration awards underscores the effectiveness of this system in achieving justice.

Ultimately, the importance of understanding and mastering the NASD arbitration rules cannot be overstated. By equipping yourself with knowledge and resources, you can navigate the complexities of financial dispute resolution with confidence. Embracing this process not only facilitates quicker resolutions but also empowers you to protect your rights and interests effectively. Taking the initiative to learn and engage with the NASD arbitration framework is a significant step toward achieving peace of mind and ensuring fair outcomes in the financial landscape.

Key Benefits of Mastering NASD Arbitration:

- Compassionate resolution: A nurturing alternative to litigation.

- Confidentiality assured: Protects your sensitive information.

- Empowerment through knowledge: Navigate conflicts with confidence.

So, why wait? Equip yourself with the tools and understanding necessary to face financial disputes head-on. Together, we can foster a fair and just financial landscape.

Frequently Asked Questions

What is NASD arbitration?

NASD arbitration is a process designed to resolve conflicts between investors and brokerage firms without the stress of litigation, adhering to specific rules that promote fair, efficient, and cost-effective resolutions.

What is an Arbitration Agreement?

An Arbitration Agreement is a contract that often requires arbitration for disputes, typically signed when opening an account, facilitating a smoother resolution process.

Who are Neutral Arbitrators?

Neutral Arbitrators are trained professionals who listen to the case and make binding decisions based on the evidence presented, ensuring a fair arbitration process.

Is the arbitration process confidential?

Yes, the proceedings are generally private, which protects sensitive information from public disclosure and allows participants to speak freely.

Why is understanding financial dispute resolution important?

Understanding financial dispute resolution is important because it can lead to faster resolutions under NASD arbitration rules compared to traditional court procedures, which can be time-consuming and costly.

What is the success rate of customer cases in NASD arbitration?

According to SIFMA, nearly 75% of customer cases are resolved favorably for the industry through NASD arbitration, highlighting its efficiency compared to litigation.

What challenges might arise within the NASD arbitration framework?

While NASD arbitration offers numerous advantages, potential criticisms and challenges may arise, which are important to consider when navigating the dispute resolution process.

How can one navigate the dispute resolution environment effectively?

By understanding the essential concepts of NASD arbitration and utilizing available support, individuals can confidently navigate their path toward resolution.